Europe – the Holy Land of Cycling

Europe is the heart and soul of cycling. When we think of cycling, we can see iconic Alpine passes, the finesse of Italian craftsmanship, and the grit of French classics. For decades, Europe was the undisputed epicenter. But the wind is shifting. A new wave of brands from Asia is emerging—not as budget factories or anonymous OEM suppliers, but as high-end cycling brands with their own distinct identities. They aren’t just shipping products – they are bringing new stories, bold visions, and a redefined sense of self.

The Great Shift – From Factories to Innovation Hubs

This transformation is impossible to ignore. The global cycling community is beginning to realize that innovation no longer happens exclusively in traditional European workshops. In the bustling streets of Taipei, the design studios of Xiamen, and the high-tech laboratories of Shenzhen, concepts are being developed that don’t just compete with established giants—they often outpace them.

This isn’t just about engineering; it’s about understanding that cycling is a cultural practice. It’s a lifestyle, a statement, and at times, a rebellion against long-standing conventions. What was once unthinkable is now reality: Asian brands are appearing in major Western magazines, dominating YouTube reviews, and claiming their spot in the pro peloton. They are being taken seriously. To some, they are still exotics; to others, they are already the most exciting players in the industry.

The Rise of Asian Cycling Tech?

The European market is deeply rooted in tradition. For years, names such as Campagnolo, Zipp, and Pinarello dominated the landscape. But while the prices of traditional brands continue to skyrocket, new challengers are knocking on the door. Brands such as Winspace, Quick Pro, SEKA, Cybrei, Tavelo, Elitewheels, Evolve, Serk, Rockbros, Ridenow, L-TWOO, Microshift, Pardus, Elves, Lightcarbon, and Zitto are systematically expanding their position in Europe.

Some score points with lifestyle, others with state-of-the-art technology, and still others with unbeatable value for money. What they all have in common is the ambition to play on the global stage. Their massive presence at Eurobike 2025 in Frankfurt showed that they are no longer just “there,” but are leading the discussion.

Below is my personal selection of brands from China and Taiwan that are worth keeping an eye on.

Premium cycling Brands from Asia

SEKA Bikes – the New Chinese High-End Performance

If there is one brand that perfectly illustrates the leap from functional to desirable, it is SEKA. For many enthusiasts, SEKA is no longer just a Chinese alternative—it has become a legitimate object of desire.

Engineering Excellence: Their current flagship, the Spear, is a example to how far they’ve come. It’s a masterclass in modern carbon engineering, combining ultra-lightweight construction with sophisticated aerodynamics. But for a designer, the Spear is more than just a collection of UCI-legal tubes. It’s a statement of visual integration. From the proprietary cockpit to the refined frame transitions, SEKA understands that in the premium segment, the eye rides with you.

The Boutique Factor: Unlike mass-market manufacturers, SEKA positions itself with the aura of a boutique brand. Their branding is subtle, their color palettes are tasteful, and their communication focuses on the ride feel. This is exactly where the industry is heading – building emotional equity through superior industrial design and a clear brand narrative.

www.sekabikes.com

Quick Pro – China’s Premium Performance Brand

The Quick Pro AR:One is a statement to the new era of ultra-lightweight carbon engineering coming out of China. With a raw frame weight of approximately 695g (size M, unpainted) and a fork at around 410g, it pushes the boundaries of what is possible. Designed for flat-mount disc brakes, 12×100 / 12x142mm thru-axles, and tire clearances up to 32mm, it is a modern racing machine through and through. A complete build is positioned at an aggressive price point of around $4,000 USD—a disruptor in the premium segment.

Quick (often referred to as Quick Bikes or Quick Pro) is a young, highly ambitious brand backed by Quick Sports Equipment (Hong Kong) Co., Ltd., with its primary production hub in Huizhou, Southern China. Since 2012, Quick has been steadily transitioning from a pure OEM/ODM manufacturer to a standalone brand.

Under the sub-brand Quick Pro, the company is aggressively targeting the high-performance racing scene. Their philosophy is Race-first. Everything revolves around performance, stiffness-to-weight ratios, and competitive edge. Their slogan, Anyone can race, underscores their mission to make professional-grade performance accessible to both elite athletes and ambitious enthusiasts.

Quick Pro doesn’t just outsource. They drive design and development internally. From proprietary carbon layups and in-house testing facilities to advanced aero profiles, their frames are engineered to sit right at the edge of UCI weight limits. Their most prominent models include the AR:One (the lightweight all-rounder) and the ER:One(the dedicated aerodynamic specialist).

YOELEO – Precision for the Long Haul

YOELEO has built a loyal global community through a consistent specialization in the intersection of gravel, aerodynamics, and long-distance performance. The brand stands out from the anonymous mass particularly through its transparency regarding manufacturing and testing processes. Their frame platforms, such as the Altera G21 or R12 series, are specifically designed for stability and comfort at high speeds—qualities that, in the Audax world, decide the crucial nuances between exhaustion and efficiency. What makes YOELEO so interesting for aesthetics enthusiasts is their departure from the dull, uniform look of many direct-to-consumer brands. With bold paint schemes, such as the Chinese opera-inspired “Chuan” edition, and a strong digital storytelling strategy, they position themselves as a brand that breathes the spirit of ultra-cycling. They impressively prove that technical know-how from the East can harmonize perfectly with the adventurous spirit of the European randonneur scene.

Cybrei (Xiamen, China) – the Lightweight Excellence

Cybrei is a specialist brand focused on ultra-lightweight carbon components for road and gravel racing. Founded by passionate cyclists with decades of industry experience, Cybrei follows a clear mission – born from riders, for riders.

Cybrei has quickly become a showcase for what modern carbon manufacturing can achieve when weight-shaving is the primary goal. Their components, particularly their integrated cockpits and cranksets, are no longer just affordable alternatives—they are top-tier upgrades that rival the most established brands in the world.

The brand stands for a philosophy where every gram counts, but never at the expense of stiffness or safety. By utilizing advanced carbon layups and precision CNC-machining, Cybrei targets the Weight Weenies and performance-driven athletes who demand the absolute best from their equipment. Their presence in the global market signals a shift – high-end components are no longer the exclusive domain of Western or Japanese manufacturers.

www.cybrei.com

Winspace – High-End from Xiamen, China

Founded in 2008 and headquartered in Xiamen, China—the global epicenter of carbon fiber manufacturing—Winspace has evolved far beyond its roots. The company does not see itself as a manufacturer of generic frames. Instead, it focuses on high-quality carbon bikes and components with a distinct character.

A Global Perspective on Engineering Winspace’s mission is to inspire cycling enthusiasts worldwide. To achieve this, the brand relies on an international design and engineering team, ensuring that their products meet the aesthetic and technical standards of the global market. By integrating professional athletes directly into the product development cycle, Winspace ensures that every frame—from the aero-optimized T1550 to the lightweight SLC3—is race-proven.

Winspace operates a vast global distribution network, proving that a brand from Xiamen can successfully transition from a manufacturer to a global household name in the premium segment. Their commitment to internal R&D and independent design has made them a benchmark for how Asian brands can win over the hearts of the international cycling community.

Elitewheels (Xiamen, China) – already arrived in Europe

If there is one name that has already firmly established itself in the European market, it is Elitewheels. Their carbon wheelsets have become a staple in technical reviews and YouTube features across the globe. The reason is a price-performance equation that is simply too powerful to ignore. Pro-Tour-level aerodynamics and lightweight technology at a fraction of the cost of legacy Western brands.

Elitewheels represents more than just a product. They represent a shift in consumer behavior. For many ambitious amateurs and performance-driven riders, the brand offers a compelling reason to question traditional brand loyalty. By delivering high-end finishes and innovative features—like their VBR (Vacuum Braking Rim) technology or carbon spokes—Elitewheels has proven that made in China can be synonymous with World-Class Performance.

Their massive presence at international trade shows and their proactive approach to international marketing have turned them into a benchmark for how a component brand can achieve global recognition in record time.

Insider Tip: Vellum Cycles (Philippines)

While brands like SEKA and Elitewheels are already establishing global footprints, I want to highlight a brand I personally encountered in Southeast Asia: Vellum Cycles. A true hidden gem, this Philippine cycling company based in Cebu has been carving out its niche since 2004.

The Intersection of Design and Sport Vellum was founded by a duo that embodies the perfect mix of business and passion: design entrepreneur and triathlete Chris Aldeguer, alongside cyclist, industrial designer, and architect Michael Flores. This background in architecture and industrial design is clearly visible in their products. Vellum focuses on high-performance road and triathlon bikes, as well as premium components, catering to both dedicated amateurs and professional athletes.

Local Roots, Global Ambition The brand is deeply rooted in the vibrant local triathlon and cycling scene of the Philippines, yet it maintains a strong international outlook. Their carbon frames—often complemented by specialized aluminum parts—are characterized by an aggressive geometry built for pure speed and performance.

By sourcing high-quality materials and components from Taiwan and adding their unique local finish and design in Cebu, Vellum has become a pioneer in the Southeast Asian carbon bike market. For the Filipino community, Vellum represents competitive quality and a proud legacy of innovation.

Elves Bikes (Taiwan R&D / China Production): The Next Generation

Elves Bikes is a prime example of the New Guard in the cycling industry. Founded in 2016, the company leverages extensive industry expertise to create high-end carbon frames and components that excel in both performance and value.

The Taiwan-China Synergy Elves understands a fundamental truth of the premium market – technology needs credibility. To achieve this, they combine the R&D expertise of Taiwanese engineering teams with the massive manufacturing power of Chinese production facilities. This synergy allows them to produce UCI-certified aero frames that meet the highest international racing standards while maintaining a competitive price point.

In many ways, Elves is following the blueprint that Canyon pioneered fifteen years ago. Selling high-performance, race-ready bikes directly to the consumer. However, they are doing it with a distinct Asian flair—focusing on bold aesthetics, rapid product iterations, and a highly accessible digital presence. By cutting out the middleman, Elves is making elite-level aerodynamics accessible to a global audience, proving that the gap between boutique and affordable is closing fast.

Lightcarbon (Xiamen, China): From Factory Floor to the Global Spotlight

For years, Lightcarbon operated primarily behind the scenes as a leading OEM manufacturer. Today, they are stepping out of the shadows with their own brand identity. They are offering carbon frames and complete bikes at price points that are making European retailers increasingly nervous. For Lightcarbon, Europe isn’t just a prestige project—it is a primary target market.

Based in Xiamen, China, Lightcarbon was founded in 2012 by an engineer with an incredible track record. Having spent years developing carbon frames for world-renowned legacy brands like Specialized, Cannondale, Colnago, and Pinarello, the founder brought Pro-Tour-level R&D directly into his own company. This deep industry knowledge is the backbone of their high-quality carbon frames and components.

Lightcarbon represents a significant shift in the industry. The manufacturer is becoming the brand. By leveraging their decades of experience in creating frames for the world’s most famous names, they are now delivering that same level of precision and performance directly to the consumer. They are no longer just making the bikes. They are defining the standards of high-end carbon manufacturing under their own name.

Lifestyle made in Xiamen: Tavelo & Evolve

Tavelo (Xiamen, China): The Rapha of the East?

Tavelo pursues a strategy that stands in stark contrast to its competitors. While others lead with engineering specs and wind-tunnel data, Tavelo focuses on lifestyle and storytelling. Their campaigns often feel like a fusion of high-end streetwear and authentic cycling culture, moving away from industrial sobriety toward a more emotional brand experience.

Tavelo’s target audience consists of young riders who view cycling not just as a sport, but as an expression of freedom and personal style. It is a highly effective approach that resonates deeply with the European market. One only needs to look at how Rapha transformed from a niche provider into a global cult icon to see the power of this strategy.

Style as a Statement By treating cycling as a cultural practice, Tavelo is building a brand identity that transcends technical components. They understand that for the modern rider, the bike is a statement. This focus on vibe and aesthetic consistency makes Tavelo a brand to watch, as they are proving that Asian manufacturers can master the art of brand allure just as well as their Western counterparts.

Evolve: Luxury and Exclusivity Defined

Evolve Bicycles, based in the carbon-tech hub of Xiamen, is a Chinese brand that epitomizes the move toward the absolute premium segment. Evolve is not just another newcomer; it is a Superbrand born from the collaboration of two industry heavyweights. Tony Tong, the founder of Elitewheels, and Mian Chan, the visionary designer behind the crankset specialist Cybrei.

Together, the founders bring over 20 years of elite engineering and product development to the table. Their shared vision is to create bicycles that represent the pinnacle of both performance and aesthetic design. Evolve isn’t just about building fast bikes. It’s about meeting the demands of the most discerning cyclists worldwide who refuse to compromise on either form or function.

By combining EliteWheels’ expertise in aerodynamics and carbon manufacturing with Cybrei’s obsession with lightweight precision, Evolve positions itself as a luxury contender. Their approach is clear – to challenge the established European Superbike brands by delivering a level of integration and craftsmanship that was previously reserved for boutique manufacturers.

Serk & Pardus

Serk (Beijing, China) – Titanium Adventures

While many brands focus on carbon fiber mass-production, Serk deliberately takes a different path. Known for its handcrafted titanium frames, this Beijing-based brand positions itself in the absolute premium segment. Serk’s customers aren’t just buying a bicycle; they are investing in a narrative—a blend of adventure, gravel culture, and the seamless connection between design and heritage.

Serk has achieved cult status among gravel and bikepacking enthusiasts. With handcrafted titanium frames, small production runs, and premium pricing, the brand evokes comparisons to legendary names like Passoni or Moots rather than typical Made in China expectations.

Serk’s success lies in its ability to fuse local Beijing cycling culture with an international thirst for adventure. By focusing on the timeless quality of titanium and a design-first philosophy, they have created a recipe that resonates perfectly with the European market, where riders increasingly look for soulful alternatives to mass-produced performance bikes.

Pardus (Shandong, China): The Agility of the Leopard

Pardus is a powerhouse in the Chinese cycling industry, specializing in the development and production of high-performance road bikes. The name Pardus is derived from the Latin word for leopard, symbolizing the agility and speed that define their bicycles.

Might Founded in 2010, Pardus is a subsidiary of the Taishan Sports Industry Group, one of the world’s largest manufacturers of sporting equipment. This backing gives Pardus a significant advantage in R&D and manufacturing capacity. Despite its scale, the brand has successfully established itself as a leader in professional-grade racing, known for its innovative designs and the use of cutting-edge materials.

Pardus bikes aren’t just for show. They are precision tools used and trusted by numerous national teams, professional cycling squads, and clubs worldwide. Their ability to deliver race-winning technology—validated at the highest levels of international competition—has earned them a reputation for reliability and elite performance in the global peloton.

Components & Innovation: The Rise of Magene, Microshift, L-TWOO, and Ridenow

The disruption of the European market isn’t limited to frames alone. A new wave of cycling component manufacturersis challenging the status quo, offering high-performance alternatives in categories long dominated by a few legacy giants. From electronic groupsets to ultra-lightweight accessories, these brands are redefining the price-to-performance ratio in cycling tech.

Magene – the Technological Intelligence Offensive

While many brands focus primarily on carbon manufacturing, Magene is conquering the market through digital intelligence and a fully connected ecosystem. Since the announcement of their official partnership with the WorldTour team XDS-Astana for the 2026 season, it has become clear that the brand has made the leap from a mere accessory supplier to a direct challenger of industry giants like Garmin and Wahoo. Their strength lies in the seamless integration of hardware and software, ranging from the high-resolution C606 smart computer to dual-sided power meters and radar-integrated tail lights like the L508. From a design perspective, the leap in UI/UX quality is particularly impressive; the user interfaces now appear clean, intuitive, and follow a clear visual hierarchy. For long-distance riders who depend on maximum data security and immense battery life, Magene currently represents the most exciting technological alternative.

Microshift – Mechanical Precision

While others chase the electronic trend, Microshift has carved out a massive following by perfecting mechanical reliability. Their drivetrains are widely respected for being bulletproof and offering intuitive shifting logic. However, having great hardware is only half the battle when entering the European market.

A Lesson in Business Etiquette

I recently had a scheduled online meeting with Microshift to discuss potential collaborations. Unfortunately, the representative simply failed to show up. When I followed up, the only response was a brief mention of being stuck in another meeting—no apology, no rescheduling effort, nothing.

This is a prime example of where some Asian brands still struggle: This is not how you conduct successful business in Europe. Technical innovation is vital, but professional reliability, punctuality, and communication are the currency of trust in the Western market. If Microshift wants to compete with the global elite, they must improve their professional soft skills to match their engineering standards.

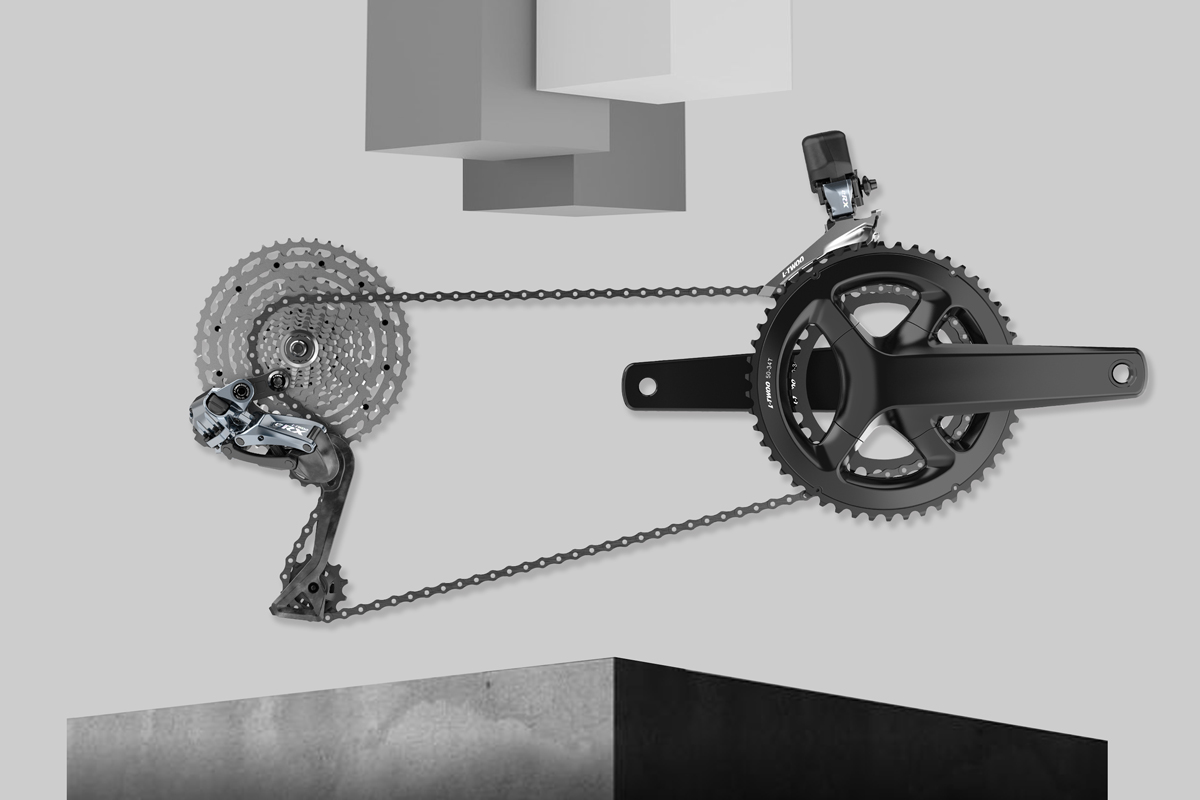

L-TWOO: Challenging the Drivetrain Monopoly

If you’re looking for the biggest buzz in the tech scene, L-TWOO is at the center of it. By developing high-end electronic and mechanical groupsets, they are providing a much-needed alternative to the industry leaders. Their flagship eR9 and eRX series have proven that wireless shifting technology is no longer an exclusive, high-priced luxury. For riders building custom bikes, L-TWOO offers a gateway to premium performance without the heritage tax.

Ridenow: The Lightweight Revolution in Your Pocket

Innovation often comes in small packages. Ridenow has taken the cycling world by storm with its ultra-lightweight TPU inner tubes. By replacing traditional butyl with high-tech thermoplastic polyurethane, they offer a significant reduction in rotating mass and rolling resistance at a fraction of the cost of carbon upgrades. It is a prime example of how Asian brands are identifying marginal gains and making them accessible to the masses.

From Price-Point Leaders to Established Brands: Rockbros & Zitto

While high-end frames grab the headlines, the foundation of the Asian cycling boom often lies in the mass market. Brands like Rockbros and Zitto have made a name for themselves by offering an incredible variety of accessories and components at prices that traditional retail brands simply cannot match. However, they are no longer just budget alternatives—they are evolving into brands with their own loyal following.

Rockbros: The Giant of Accessories

Rockbros is arguably the most visible Chinese brand on European streets. Whether it’s bikepacking bags, lights, or apparel, their presence is ubiquitous. They have mastered the art of democratizing cycling gear. What started as a price-driven strategy has turned into a massive ecosystem of products. For many riders, Rockbros is the entry point into the world of cycling tech, proving that reliability and style don’t always need a premium price tag.

Zitto: The Components Specialist

Zitto follows a similar path but focuses on the technical side. From colorful CNC-machined stems to cassettes and tools, Zitto has become a go-to for DIY mechanics and bike builders. Their strength lies in their agility—they can bring new colors, standards, and designs to the market at lightning speed. For the European market, Zitto represents the creative workshop of the East, offering parts that allow riders to customize their bikes without breaking the bank.

Origin & Brand Profiles

| Brand | Origin | Primary Focus | European Market Strategy |

| Cybrei | China (Xiamen) | Ultra-light Carbon Components | Direct-to-Consumer (DTC), Social Media |

| Tavelo | China (Xiamen) | Lifestyle & Performance Bikes | Community Building & Design-Led |

| Elitewheels | China (Xiamen) | Carbon Wheelsets | Price/Performance + Influencer Marketing |

| Evolve | China (Fujian) | High-End Carbon Bikes | Boutique Approach, Direct Distribution |

| Serk | China (Beijing) | Titanium Frames | Niche Markets & Exclusivity |

| Pardus | China (Shandong) | Carbon Road Frames | UCI Team Support, Mass-Production Power |

| Microshift | Taiwan | Drivetrains / Groupsets | OEM Partnership + Aftermarket Sales |

| L-TWOO | China | Drivetrains / Groupsets | Disrupting the “Big Three” Monopoly |

| Ridenow | China (Qingdao) | TPU Tubes & Accessories | Tech Reviews & Viral Marketing |

| Rockbros | China (Yiwu) | Accessories & Gear | High Volume → Premium Product Lines |

| Zitto | China | Parts & Tools | Community-Driven Enthusiast Market |

| Elves | Taiwan R&D / China Prod. | Carbon Frames | Hybrid Model, Direct Sales |

| Lightcarbon | China (Xiamen) | Frames & Wheelsets | Transitioning from OEM to Global Brand |

Frequently Asked Questions: The Reality of the Asian Cycling Boom

Are Asian brands truly high-end or just cheaper alternatives?

Many have long since crossed the threshold into the high-end segment. Brands like Serk, Pardus, and Elves deliver quality that is on par with established Western manufacturers. Today, the price advantage is a welcome bonus, but the primary driver is the actual performance and engineering.

Why are Asian brands more affordable?

The competitive pricing is a result of Direct-to-Consumer (DTC) models, fewer middlemen, local government subsidies, and lower production overheads. However, as these brands establish a physical presence in Europe (including service centers and warehouses), prices are gradually beginning to align with global standards.

Which Asian brands are the real gamechangers?

In the wheelset category, Elitewheels is leading the charge. In the components segment, L-TWOO is the one to watch, while Serk is redefining what is possible in the titanium market.

What does this mean for established European brands?

It means significant pressure and increased competition. Legacy brands must communicate their value proposition more clearly than ever before—whether through their long-standing tradition, superior local service networks, or genuine, disruptive innovation.

A Shift in Status Symbols?

High-end products in cycling are more than just hardware—they are an expression of culture. For decades in Europe, riding a Campagnolo groupset or a De Rosa frame was a badge of prestige. These brands didn’t just represent quality. They told stories of Italian elegance, French esprit, and a tradition that shaped generations.

But the question arises: Can Asian brands capture that same space in our collective consciousness? Status symbols are not born from price or performance alone. They thrive on myths, on narratives, and on the unspoken agreement of a community that an object is more than the sum of its parts. They are canvases for identity, pride, and aspiration. And these myths don’t have to be born in Milan or Lyon—they can grow in Xiamen, Taipei, or Beijing.

When Serk casts the promise of adventure and freedom into titanium, or Elitewheels fuses uncompromising performance with accessibility, new symbols begin to take shape. Their value lies not just in carbon or metal, but in the stories they carry—stories of courage, innovation, and a new era. They simply need to be told with authenticity.

Perhaps one day, the European peloton will no longer be surprised when a bike from China is viewed not as a budget alternative, but as the statement of a new generation. A status symbol is no longer defined solely by its heritage, but by the vision behind it and the passion it embodies. It is at this precise intersection that Asian brands have the chance to write their own history. #storytelling

Learn more about this topic with Richie & Tobi (38 min.)